Payday

Up to 43 million are going to earn student loan forgiveness.

President Joe Biden announces a plan to reduce the nation’s student loan debt.

September 12, 2022

On Aug. 24, President Biden announced a three-part plan to aid those with outstanding student loans.

This plan aims to mainly help those who received a Pell grant, which generally are given to students whose families earned less than $60,000 a year. There is also aid for those who didn’t receive a Pell grant.

To qualify for the aid, a person must have outstanding student loans with the Department of Education and have an individual income of less than $125,000 a year, or $250,000 for married couples.

Those who meet this criteria and were given a Pell Grant can receive up to $20,000 in loan forgiveness. However, if one didn’t receive a Pell Grant, there is still up to $10,000 in loan relief available.

This plan was proposed due to the financial hardship that many faced during the pandemic, especially those who were deemed “low income” and who were struggling with their student loans.

Statistics have shown that while the maximum amount of money that Pell grants have given has stayed relatively consistent since the 1980s, the average cost of attending a public university has risen significantly from around $8,000 in the 1980s to roughly $22,000 in the 2020s.

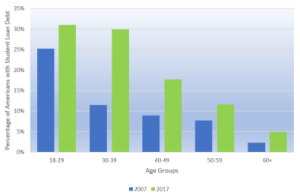

This means that the average undergraduate is about $25,000 in debt.

Additionally, one-third of those with student loan debt don’t have a degree, because they couldn’t finish college due to the high cost of attendance.

This, combined with the fact that a $15 minimum wage is 225% below the federal poverty level, shows a dangerous trend when it comes to Americans and their income, which the White House hopes to help with.

This move does not come without backlash however, as many are upset with this seemingly radical move by President Biden.

Some are arguing that those who chose to go to college should have to pay off their own debts themselves. Those who didn’t go to college made the decision not to accumulate those debts, therefore shouldn’t have to pay off other people’s loans with their tax dollars.

Others feel this is a beneficial plan because of the current economic direction of the country. Those who agree feel students who accumulated those debts shouldn’t have to suffer with them for the majority of their lives because the price of college is currently so high.

For instance, twenty years after enrolling in college in 1995-1996, the typical black student loan borrower still owed 95% of their original debt, which shows that debt can be a life-long issue.

However, part of this plan also includes a section to help future borrowers too, which could possibly extend the time it takes to pay off the debt.

This part of the plan proposes to make debt payments income driven, with monthly payments for loans being no higher than 5% of the borrower’s income, but this could make the time needed to pay off loans much longer.

Although the future of this order is uncertain, the President had good intentions and hopes that it could help the United States recover from these rough couple of years.