The plan, the process, and the division – Biden’s Student Debt Forgiveness Plan

Dissecting President Biden’s plan to relieve millions of dollars worth of student loan debt.

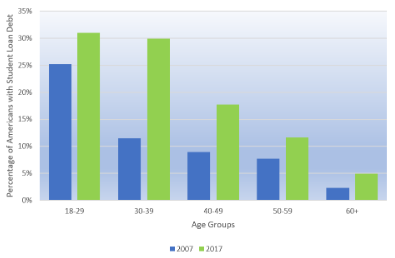

Graph analyzing student loan debt across age groups.

September 12, 2022

In an effort to relieve college students from debt, President Joe Biden’s student loan forgiveness plan, in theory, will target low-to-middle income borrowers.

Biden’s electoral promise comes in three parts, and this plan overall promises to cancel at least $10,000 of student loan debt per qualifying person.

Student loan debt has become problematic, being that the total cost of higher-level education has nearly tripled since 1980. Now, the average undergraduate student has nearly $25,ooo in student debt in the United States.

This emergency relief plan was mainly implemented in response to the COVID-19 pandemic, during which students were allowed to defer from their loan payments. Deferring payments held the burden of millions of dollars on borrowers in the U.S., especially in the middle class.

Taxes:

On the surface, this plan will seemingly help many borrowers. However, Biden’s student debt forgiveness plan raises many questions from taxpayers, students, and politicians. Mainly, these questions are in regards to inflation, tax payers, and if Biden even holds the authority to implement this program.

Under the American Rescue Plan Act (ARPA), student loan debt between 2021 and 2025 shall be forgiven, and it shouldn’t count towards their federal taxable income.

However, there are some states that exclude this plan from their own state income tax bases, meaning that not every state will implement this program equally.

To cancel student loans, under the Internal Revenue Code (IRC), states would be suggested to exempt themselves from their current version of ARPA and IRC, and to be more selective with these codes and acts.

The Biden administration acknowledges that their loan forgiveness plan would not be of consideration to federal tax income, under ARPA. On a state level, however, the forgiveness plan is not exempt as long as the state follows the federal law in regard to the state’s treatment of loan relief.

Even so, 13 states have already taken the loan forgiveness plan as a taxable income. This means those receiving up to $10,000 in loan forgiveness will later receive taxes on it, ranging from $300 to $1,000.

It is predicted that more states will conform with the federal government’s plan not to tax this debt relief, but it has been suggested that borrowers consult with a tax preparer prior to their accommodation.

The Process:

Due to the cost of attendance, many students are forced to leave college without a degree.

To address this issue, this program is supposed to assist those in working class families and address the increasing cost of attendance.

Thus, President Biden has reported that the role of the Department of Education is to address financial hardship many borrowers have faced due to the pandemic, ensure that the student loan system is easier to navigate for borrowers, and have a direct plan on debt relief.

Beyond this, the Department of Education is expected to reduce the payments of undergraduate student loans. As well as reconstructing the Public Service Loan Forgiveness (PSLF) by creating new rules for those who are in the military, employed at a nonprofit, or government organization.

These rules should ensure that these borrowers receive adequate credit for their loan forgiveness, and protect these students and taxpayers from paying full price for attendance.

Another form of action the Department of Education is responsible for is holding public and private institutions accountable for unnecessary increases for attendance.

Overall, the urgency for this program is on behalf of the Biden administration as this plan is a campaign commitment.

Thus, if the plan is successful, it could potentially relieve roughly 43 million borrowers from the remaining balance of their debt, assist those of all ages, and promote racial equity in higher level education.

Debates and division:

One of the many arguments against this program is the approach, whether it should be universal or a target policy.

With this, some argue that with a universal policy, those who do not need relief from debt will still receive these benefits. Thus, it brings an inequitable and unfair approach to this plan. Beyond this, universal approaches tend to be more expensive as they are known to pay off the upper class, rather than those in financial need.

In contrast, the targeted approach focuses on those who qualify for debt forgiveness and it relieves a portion of their loans, which is determined by the amount of debt the individual has. The target approach also advocates for equity and providing financial support for those in need.

This forgiveness plan is heavily advocated for by left-leaning congressional officials. Beyond this, candidates such as Bernie Sanders and Elizabeth Warren campaigned on promises that are seen to be more generous for debt forgiveness.

Biden’s plan, however, is considered to be a more moderate approach to Sanders and Warren’s promises.

Currently, Democratic economists have been blamed for fueling skyrocketing inflation by proposing unattainable social welfare services.